We have all been told that we should live within our means, save for a rainy day, and pay our bills on time. But what does that mean when it comes to our finances? And how can we tell if we are truly healthy financially?

A recent FINRA Investor Education Foundation study sought to answer these questions and more. The study found that financial health is a better measure of overall consumer health than traditional limited metrics like a consumer’s credit score and debt-to-income ratio.

In this article, we explore what we believe is a superior measure of a user’s financial health and ultimately overall credit risk. Here we begin with an overview of the traditional approach of the credit report and credit scores as a barometer of consumer risk and introduce a new metric that we argue is superior in its ability to measure risk as well as provide credit education.

Credit Scores and Credit Reporting:

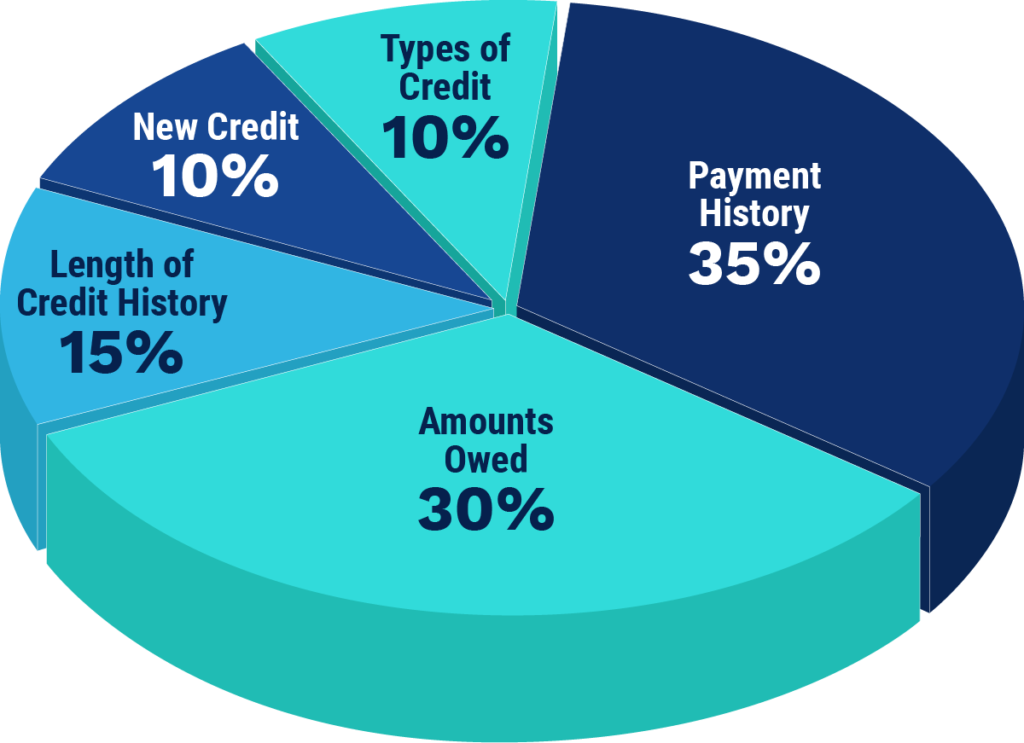

Credit scores are designed to measure the risk of default by taking into account various factors in a person’s financial history. Although the mechanics of the algorithms that determine credit scores are kept secret, the following components are used to determine a consumer’s credit score.

Payment History (35%) –

Best described as the presence or lack of derogatory information.

Debt Burden (30%) –

Consist of several debt-specific measurements including the debt to limit ratio, number of accounts with balances, the amount owed across different types of accounts, and the amount paid down on installment loans.

Length of Credit History (15%) –

Includes two metrics in this category: the average age of the consumers’ accounts on a credit report and the age of the oldest account on a credit report.

Types of Credit Used (10%) –

Consumers can benefit by having a history of managing different types of credit accounts including some or all of the following: loans including installment loans, revolving credit like a credit card, consumer finance, and mortgage accounts.

Recent searches for credit

Hard credit inquiries or “hard pulls,” occur when lenders evaluate a credit report after a consumer has applied for a loan, a credit card, or any other type of new account. While lenders are pulling the user’s credit report to evaluate the user’s credit history, credit scores, and other relevant credit information, this can hurt scores, especially if done in great numbers.

If you are shopping around for a mortgage, auto loan, or student loan over a short period (two weeks or 45 days, depending on the credit score used) you should not expect to experience a meaningful decrease in your credit score as a result of these types of inquiries. This is because the scoring models only consider these types of hard inquiries that occur within 14 or 45 days of each other as only one and mortgage, auto, and student loan inquiries do not count at all in credit scores if they are less than 30 days old. While all credit inquiries are recorded and displayed on a personal credit report for two years, they have no effect after the first year on credit scores.

Credit Score Ranges

There are several types of credit scores but all credit scores will generally fall within the same credit score ranges although a user’s credit score can differ depending on the use. Credit scores are generally broken down into the use in which the credit score is intended to be used: classic, generic, or general-purpose credit scores; industry-specific credit scores (e.g., bank credit score, credit score, auto credit score, mortgage credit score, personal finance credit score, and installment loan credit score).

If your head is starting to hurt with all of these different credit scores (and they are more!!) you’re not alone! Credit scores are a measure of financial health but below we argue that it is one that where relied upon in isolation has serious limitations for lenders, credit card companies, and other parties. Relying on credit scores to determine who is eligible for a lender or credit product and if they are eligible for the product, whether they will pay lower interest rates or higher interest rates compared to other consumers can result in a type of application bias.

While traditional models have sought to tackle some of the issues we are going to identify below by employing different scoring models, these models have simply resulted in a greater number of credit scores that potentially reinforce the same application bias. In short, relying on credit reporting and credit history in isolation can restrict access to the availability of credit to consumers who often need it the most.

The Limitations of Traditional Models

So what exactly is financial health and why does it matter if we already know our credit score?

Above we laid out the components that make up credit scores but what we didn’t tell you is why credit scores can differ among different credit reports provided by the same company (Equifax, Transunion, or Experian) as well as credit reports provided by different reporting companies. The reason is simple…no one other than these three companies truly understand why differences exist in scores within the same user credit report as well as between credit reports provided by different reporting companies. Now if you have a good credit score then the differences in your scores, whether within the same credit report or between credit reports provided by different companies, will likely be negligible.

But what about everyone else?

- What if you’ve had some setbacks and your scores have suffered?

- What if you’ve had a difficult time being approved by lenders for credit?

- What if you have a lender that extended credit to you but your interest rate is so high, that you pay more every month because of the high-interest rate and the balance on your debt never comes down?

- What if you’ve given up on your credit score altogether?

According to the Financial Health Network, approximately 36% of the U.S. adult population, or 91 million people have subprime scores of below 600 or are un-scorable because of a lack of sufficient credit file information. So if you were building a credit education course for them, what specific steps would you tell them to take in order to strengthen their financial profile?

Many of the steps that we would advise consumers, to begin with, are: (i) either not covered at all in determining credit scores and building credit reports or (ii) do not receive sufficient enough weighting in a user’s credit report to properly reflect the overall health of the consumer that it creates for a consumer.

For example, we would explain to consumers how an insurance policy can change the trajectory of their family’s lives in the event of death or disability.

We would tell a consumer that while keeping credit card balances low is important, an account with a high rate of interest that can’t be paid off in full each month potentially destroys a user’s ability to improve other factors that matter more to a user’s future than simply having a good credit score.

As discussed above, other challenges with relying on traditional credit scoring models relate to the fact that users often have multiple scores that are derived from obscure scoring models built and kept under lock and key by the three credit bureaus. Although what constitutes a good credit score is generally understood to mean the same thing among the three bureaus, users can experience large spreads between their credit scores and these different scores can have dramatic effects on lending decisions for everything from mortgages, insurance, a car loan, etc.

The Definition of Financial Health

Financial health is defined as “a state of being wherein a consumer can fully meet current financial obligations, feel secure in their financial future and make choices that allow them to enjoy life.” In other words, it’s not just about having a good credit score or a low debt-to-income ratio.

From a consumer’s perspective, it’s about feeling confident and secure in your financial future and if you’re a lender it’s about having a more holistic view of a consumer’s health as it relates to money and his/her overall credit risk.

Traditional credit scoring models have historically focused on whether a user’s credit report presents an acceptable consumer profile looking at factors such as the number of credit accounts, credit card balances, credit utilization rate, available credit, and other obscure variables that are believed to increase a user’s likelihood of repayment. However, they often ignore factors like a user’s ability to adequately deal with an emergency that has financial implications or how a loan might affect a user’s ability to plan for their financial future. We believe lenders who in the future learn to look beyond credit reports will be better positioned to underwrite responsibly and build healthier, long-term relations with consumers.

The Components of Financial Health

So how can you tell if you’re financially healthy? Financial health is measured by taking a broad look at a consumer’s overall financial well-being and is focused on evaluating the ability to manage day-to-day living, withstand financial crises and also take advantage of opportunities that could positively benefit the consumer down the road.

So let’s first dive into a definition of the eight factors that comprise financial health:

Spending Measure –

Spending is less than income: This one seems pretty self-explanatory. If you’re spending more than you’re bringing in, it’s going to be tough to get ahead financially. But the analysis doesn’t simply stop there. Ultimately, this factor also measures a consumer’s ability to live within their means. Whether a user receives public assistance from the United States government or has more money than they know what to do with, this measure is a good starting point for understanding a consumer’s psyche and how much flexibility might exist to make structural changes.

Unless spending occurs on an account captured within a credit report, credit reports lack the ability to ensure this in any statistically meaningful way.

Bill Pay Measure –

Pay all bills on time: This includes everything from your mortgage or rent to your credit card bills and utility payments. While credit scores take into account a person’s payment history for purposes of calculating their score, the analysis is a backward-looking measure of credit reporting and also lags the credit decision date by up to 30 days and will only include accounts that are reporting to the bureaus.

By contrast, in this matrix, the use of the factor for evaluating the health of the consumer can be updated in real-time with each payment by a user of a bill. While we have seen companies like Experian attempt to address this deficiency in its credit reporting with the launch of solutions like Experian Boost, the product leaves a lot to be desired both in terms of what bills can be included and how certain bills are reported.

Liquid Savings –

Sufficient liquid savings: Liquid savings are funds that you can easily access in an emergency. The study found that financially healthy consumers have liquid savings that equal to or exceed three months of living expenses.

For consumers who tend to be more financially vulnerable, the need for a savings cushion is critical to maintaining financial health. We would argue that lenders who don’t have a tool at their disposal to measure not just the amount of savings a consumer has at any point in time but also to see the improvements that he/she has made over time in being able to accrue savings are missing a crucial part of what we believe to be a relevant factor in a credit decision.

Goal Planning –

Confidence about long-term financial goals: This includes things like retirement planning and saving for your children’s education. If you don’t feel confident that you’ll be able to meet your long-term financial goals, it’s a good sign that you need to make some changes.

Debt Level –

A manageable amount of debt: This doesn’t mean that you should avoid all debt. But if your debts are manageable and you’re making regular, on-time payments, it’s a good sign that you’re financially healthy.

So what constitutes a manageable amount of debt?

We would argue it differs based on dynamic variables attributable to a particular person. We believe interest rates on debts are just as important as the types and amounts of debt.

Prime Credit Score –

Prime credit score: A prime credit score is generally considered to be anything above 700.

Insurance Coverage Sufficiency –

Confident about the sufficiency of insurance coverage: We define this to include traditional health insurance and life insurance as well as more niche products that protect consumers against loss of income, and housing, and protect against identity theft. Make sure you have enough coverage to protect yourself and your family in case of an emergency.

Financial Planning –

Plan ahead financially: This includes things like creating a budget and sticking to it. It also means setting aside money each month for savings and investing for the future.

Your Financial Health

When it comes to financial health, these are the eight factors that we use to measure it. If you’re not doing well in one or more of these areas, it simply means that you have an opportunity for growth. By taking steps to improve in these areas, you can help ensure your future financial security. And that’s something we all want.

Stay tuned for future posts on this topic and also join our waitlist at Nevly where we’ve created the first-of-its-kind AI-powered financial health assistant (Eve). Eve will walk you through calculating your initial financial health score and provide you with dynamic advice on ways to improve the areas of your score that aren’t as strong as they should be.

We can’t wait for you to meet her!